Personal Loans

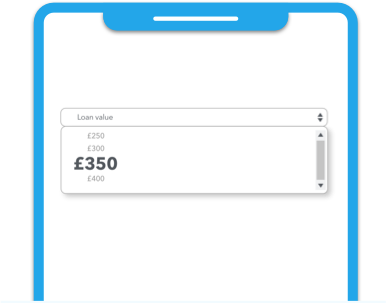

From £250 to £2,000, repaid over 18 or 24 months

- Loans from £250 - £2,000

- No obligation eligibility checker

Representative example: If you borrow £550 over 18 months at a flat rate of 168% per annum (fixed) with a representative 679% APR you will make 18 monthly payments of £107.56, repaying £1,936.08 in total. This means you would pay £1,386.08 in interest in addition to the amount borrowed. The rate and term you are offered is dependent on your individual circumstances.

Warning: Late or missed repayment can cause you serious money problems and may affect your credit record. For independent help, please go to www.moneyhelper.org.uk

Get your funds in 3 simple steps

Borrow from £250 to £2,000 | Online Application | Quick Decision

1

Check your eligibility

2

If you're eligible

3

Same day transfer

When might a personal loan help?

Whether you need money for unexpected bills, car repairs, appliance breakdowns, family emergencies, or to cover the costs of medical, dental, or veterinary treatment, a personal loan may help in an emergency. However, it is important to consider whether borrowing is the right option for you. If you are struggling with ongoing financial difficulties, free and confidential debt advice may be more appropriate.

Who can apply?

You can apply whether you are a homeowner, tenant, or live with your parents.

To be eligible, you must:

- Be 21 years or over

- Have a regular income from employment

- Be resident in the UK

- Have a UK bank account and debit card

We assess every application individually. Having a less-than-perfect credit history does not automatically mean you will be declined.

Our free eligibility checker lets you see whether you are likely to be accepted without affecting your credit score. If you choose to continue with a full application, a credit check will be carried out and may leave a footprint on your credit file. Click Get Started to begin.

Who we are

Loans 2 Go is a direct lender. This means:

- You apply directly to us

- We make our own lending decisions

- There is no intermediary involved

Need help or want to talk?

If you would like to discuss your application or have questions before applying, you can contact us:

0330 400 6000

If your financial situation changes or you are worried about repayments, please contact us as soon as possible. We can discuss support options. You can also get free, independent advice from MoneyHelper.

How much can I borrow?

- Loan terms: 18 or 24 months

- No set-up fees

- Repayments can be made weekly, fortnightly or monthly

- Payments are collected by debit card (Continuous Payment Authority, CPA) or via our online portal

You can cancel your CPA either with us or your Bank at any time. Cancelling your CPA does not cancel your repayment obligation. If you cancel your CPA, you must agree an alternative repayment method with us but if you do this, you must arrange for another way to make your repayments.

Early repayment

You can repay your loan in full or in part at any time without any penalty.

If you repay early, you may reduce the amount of interest you pay. You can request an early settlement figure whenever you wish by contacting us.

Is this loan right for you?

A personal loan may help in some situations, but it is important to consider whether borrowing is the right option for you.

This type of loan may be suitable if:

- You need emergency access to funds

- You understand the total cost and are confident you can afford the repayments

- You have considered other, lower-cost options and they are not available to you

This type of loan may not be suitable if:

- You are struggling to meet regular living costs

- You need to borrow repeatedly to get by

- You are considering borrowing for everyday expenses or non-essential spending

If this applies to you, free and confidential debt advice may be a better option. We encourage you to take time to consider your options before applying.

You can get support from organisations such as StepChange Debt Charity or Citizens Advice. You can find more information here.

Personal loans | 18 or 24 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Confidential &

secure

Money

same day

(Subject to working hours)

FAQ

You may be able to borrow from as little as £250 up to £2,000. As long as it’s affordable for you, we’ve got you covered.

You need to be:

- At least 21 years’ old;

- Currently in employment with a regular income; and

- A resident in the UK with a UK bank account.

At Loans 2 Go you can see if you’re likely to qualify for a loan using our eligibility checker. This is a soft search and will not impact your credit score. If pre-approved and you complete our full application then, as a responsible lender, we undertake credit checks to establish the loan is affordable. We do lend to people with poor credit history, however, we would only lend to customers that can afford the repayments.