£500 loan

- Loans From 18 months to 24 months

- Settle at any point without penalty

- Representative 679% APR

Representative example: If you borrow £550 over 18 months at a flat rate of 168% per annum (fixed) with a representative 679% APR you will make 18 monthly payments of £107.56, repaying £1,936.08 in total. The rate and / or term you are offered is dependent on your individual circumstances.

Get your funds in 3 simple steps

Borrow from £250 to £2,000 | Online Application | Quick Decision

1

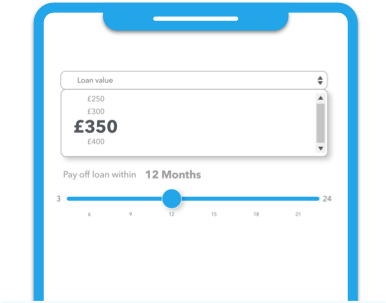

Select your required amount

2

Get an instant decision

3

Same day transfer

Why might you need a £500 loan?

There are so many reasons why you might suddenly need to get your hands on £500. Whether it’s some kind of family emergency, home or car repairs, or a bill that you weren’t expecting, you are left short of money and need to find some extra money fast.

£500 loans from Loans 2 Go could get the money into your bank account the very same day*.

And once you have the money you can do whatever you like with it, there are no restrictions.

Who is eligible for a £500 loan?

There are some simple eligibility criteria for a Loans 2 Go £500 loan: We require you to be:

- Aged 21 years or over;

- Currently employed with a regular income;

- Resident in the UK. This can be either as a homeowner, tenant, or living with parents;

- UK bank account holder on a debit card.

If your credit score is less than perfect, we will still consider lending to you. As part of the loan approval process, we will check the affordability of the loan repayments for you.

We don’t want you to take on debt that you are unable to repay. But we treat each application on an individual basis, and as long as you are able to afford your £500 loan repayments now, poor credit history need not prevent us lending to you.

How much would a £500 loan cost?

The total cost of £500 loans depends on the length of your repayment period.

There are no charges to set up £500 loans, and no early repayment fees if you decide to repay all or part of your £500 loan before the end of your repayment period.

£250 - £2,000

personal loans

How can I apply for a £500 loan?

Applying for £500 loans with Loans 2 Go is easy. You can do this online from the comfort of your own home. There is no face to face interview and no forms to post.

Our loan application process is straightforward and simple. To apply for a £500 loan with us, all you need to do is:

- Click Apply Now and select £500 loan.

- Enter your details into the online form and submit it to us.

- As a direct lender we can then give you an instant lending decision and we aim to get the money into your bank account the same day*.

So, if you need a £500 loan, and need it fast, look no further than Loans 2 Go.

Personal loans | 18 or 24 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Over 2,000,0000

people helped

Confidential &

secure

Money

same day

FAQ

We do not charge any set up fees when you take out a personal loan with us.

As a responsible lender we undertake credit checks to establish the loan is affordable, but we lend to people with poor credit history. However, we would only lend to customers that can afford the repayments.

We are very flexible and provide repayment options of weekly, fortnightly, or monthly.