There are many reasons why you might be considering taking out a personal loan. The two most common purposes of loans in the UK in 2025 are for buying a car or undertaking home improvements. Other reasons include debt consolidation loans, holidays and weddings.

Whatever your reason for looking for a loan, you will soon realise that there are many loan providers out there. But it’s important to be aware that all loans are not the same. For example, there will be different interest rates on loans – making some loans more expensive than others. Some lenders will give you less time to repay a loan, whereas others may charge you additional fees if you want to repay it early.

So when taking out a personal loan, you need to be very sure that you understand all the terms and conditions, so that there are no nasty surprises later on.

To help you do this, here are five things that you need to check when choosing a lender.

What rate of interest is charged on the loan?

When you take out a loan you will need to repay the lender not only the money you originally borrowed, but also the interest they charge on the loan. The higher the rate of interest on the loan, the more expensive the loan and the higher your loan repayments will be.

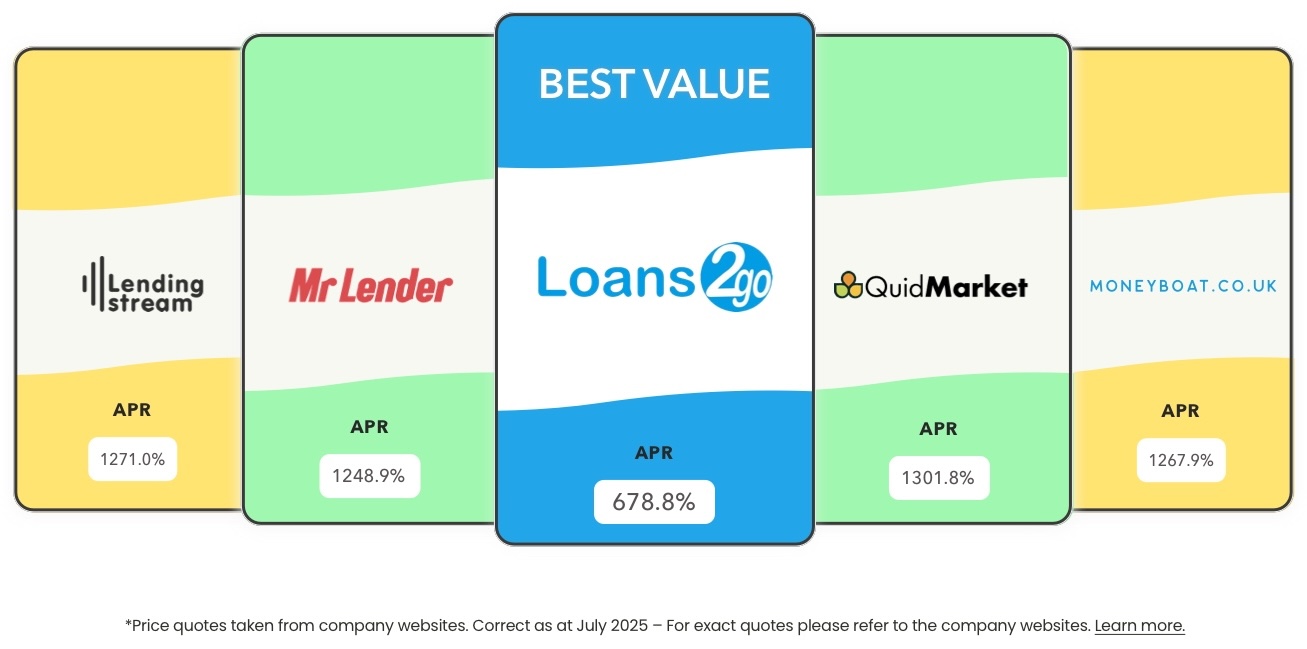

So when looking for a personal loan, it’s important to compare interest rates between different lenders. For example, you will find that a personal loan from Loans 2 Go is much cheaper than other loans on the market from lenders such as Lending Stream or Quidmarket.

Are there any charges for the loan?

As well as charging interest on the amount of money you are borrowing, some lenders may also apply additional charges to the loan for setting it up. So make sure that you read the small print so that you know exactly how much you have to pay and for what. You will find that there are many lenders – such as Loans 2 Go – who offer personal loans with no set up fees.

Also check whether there would be any other charges for late payments. It can be very easy to miss a loan repayment and if you then have to pay a charge for it, this will increase the size of your loan. Loans 2 Go does not charge late payment fees, unlike other lenders such as Lending Stream.

What is the repayment period of the loan?

When taking out a personal loan it can be tempting to choose a very short repayment period so that you can get the loan out of the way as soon as possible. The problem with this is that the shorter the repayment term, the higher your loan repayments will be.

A better option could be to look for a loan with a longer repayment period. For example, Loans 2 Go offer personal loans with repayment periods of 18 to 24 months. This means that your monthly repayments will be much lower.

So when looking for a loan, explore the different repayment periods offered. Lending Stream have a 6 month repayment period, and Quidmarket 3-6 months, both of which could be shorter than you comfortably need to sort out your finances.

How easy is it to repay your loan early?

We have just considered the benefits of taking out a loan with a longer repayment period to keep the monthly repayments manageable. However, as you will be paying interest with every repayment, it is a good idea to pay the loan off sooner if you are able to do so.

So when taking out a personal loan you need to be clear as to whether your lender would allow you to pay off your loan early, and also whether they would charge you any kind of penalty or early repayment fee for doing so.

With a Loans 2 go personal loan you would have an initial repayment period of either 18 or 24 months. But if, for example, you were able to repay it after just 12 months, you would then save the interest that you would have paid over the rest of the loan term. And Loans 2 Go would not charge you anything for repaying your loan early.

Is your lender regulated by the FCA?

Last but by no means least is that when taking out a personal loan it’s really important to ensure that your lender is regulated by the FCA (Financial Conducts Authority). The FCA is the body that regulates consumer finance providers, products and services and can help you if you experience any issues with your loan provider. And in the worst case scenario – your lender going out of business – there is the Financial Services Compensation Scheme which can step in to pay compensation.

You can check whether your lender is regulated by the FCA on the Financial Services Register.

We hope that the above information helps you to make the best choice of loan provider and avoid any potential pitfalls along the way.

For more tips on family finances and lifestyle, remember to visit us here again soon at Loans 2 Go.

Now is the time to start planning your financial goals for 2026

Now is the time to start planning your financial goals for 2026