18 Month loan

- No obligation eligibility checker

- Rated excellent on Feefo

DIRECT LENDER

ONLINE APPLICATION

NO SET UP

FEES

Representative example: If you borrow £550 over 18 months at a flat rate of 168% per annum (fixed) with a representative 679% APR you will make 18 monthly payments of £107.56, repaying £1,936.08 in total. This means you would pay £1,386.08 in interest in addition to the amount borrowed. The rate and term you are offered is dependent on your individual circumstances.

Warning: Late or missed repayment can cause you serious money problems and may affect your credit record. For independent help, please go to www.moneyhelper.org.uk

Get your funds in 3 simple steps

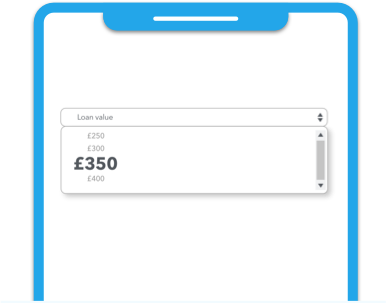

Borrow from £250 to £1,500 | Online Application | Quick Decision

1

Check your eligibility

2

If you're eligible

3

Same day transfer

Why might you need an 18 month loan?

Sometimes you need a helping hand to get through difficult times. This applies just as much to money as any other area of your life.

However well you plan, your finances can sometimes be put under strain. Whether it’s urgent car repairs, an appliance breakdown, a family emergency or a large unexpected bill, you need some extra money fast.

One solution might be a loan. When you’re considering taking out a loan, there are several advantages to making it an 18 month loan:

- Your loan payments are spread out evenly across the duration of your 18 month loan making your payments more manageable;

- An 18 month loan may give you the time you need to manage any unexpected expenses;

- There is always the opportunity to repay your 18 month loan early.

Would I be eligible for an 18 month loan?

Yes, possibly. It very much depends on your current financial situation. We will consider lending to you provided you are able to afford the repayments on an 18 month loan.

Using our eligibility checker, you can find out if you’ll be provisionally accepted without it impacting your credit score. If you are provisionally accepted and choose to complete the full application, only at that point, will we check your credit report as part of the 18 month loan application process.

To apply for an 18 month loan with us, you need to be:

- At least 21 years’ old;

- Currently employed with a regular income;

- Resident in the UK, either as a homeowner, tenant, or living with parents;

- The holder of a UK bank account and debit card.

How much can I borrow with an 18 month loan?

Loans 2 Go offer 18 month loans between £250 and £1500.

You can repay your 18 month loan in either weekly, fortnightly or monthly instalments, whichever works best for you. You can pay us either via Continuous Payment Authority debit card repayments or by using our online payment portal.

There are no fees for setting up your 18 month loan, and there is always the opportunity to repay your 18 month loan early.

£250 - £1,500

personal loans

How do I apply for an 18 month loan?

You can apply quickly and easily for an 18 month loan with us online.

All you need to do is:

- Click Get Started

- Select how much you want to borrow

- Provide us with basic information

Our eligibility checker will give you an instant decision on whether you have been provisionally accepted without it affecting your credit score. If successful you can choose to complete the application form and if approved get the money into your account, the same working day (subject to working hours).

If you prefer to discuss your loan application in more detail, you can either call us on 0330 400 6000 or email us at [email protected].

Personal loans | 18 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Confidential &

secure

Money

same day

FAQ

Our 18 month loans are £250 – £1,500. However you may be able to borrow up to £2,000 (24 month loan). As long as it’s affordable for you, we’ve got you covered.

At Loans 2 Go you can see if you’re likely to qualify for a loan using our eligibility checker. This is a soft search and will not impact your credit score. If pre-approved and you complete our full application then, as a responsible lender, we undertake credit checks to establish the loan is affordable. We do lend to people with poor credit history, however, we would only lend to customers that can afford the repayments.

APR stands for Annual Percentage Rate. This is the rate at which someone who borrows money is charged. It is calculated over a twelve-month period and is shown as a percentage. The APR percentage represents the actual yearly cost of the funds over the term of a loan.