Are You Throwing Away £1000’s

…On Rent Every Year?

First time buyers

For many of us today, buying a home seems like an impossible dream. But is doesn’t have to be…

Only 9% of 25-34 years olds in the UK own their own home, and the average age of a first time buyer in England is 32 (34 in London). So you’re not alone!

For those in the 25-34 age group that do not own their own home around:

- – 42% live in private rented accommodation;

- – 18% live in social rented accommodation (housing associations and local authorities);

- – 28% live with their parents or other family.

But if you are in the majority of the 25-34 age group who rents privately, do you realise that you are most probably paying more in rent than you would on a mortgage? You could be throwing away thousands of pounds a year! Money that could be going towards your own home instead.

How much rent do you pay a year?

A typical monthly rent for a home in England is £730: and in London is £1,430. The interactive map below, produced by the Office of National Statistics, shows median rental costs across the UK.

This means if you rent a home you could be paying between £8,760 and £17,160 a year for someone else’s home. Sometimes even just a room in someone else’s home.

Why not put that money into your own home instead?

In this paper we take a look at:

- Are you eligible for a mortgage?

- How to improve your chances of being accepted for a mortgage

- How much will you be able to borrow?

- How to get a good mortgage deal

- Government schemes to help you buy a home.

The cost of buying your first home

According to Gov UK, the average property price in the UK is now £255,535. To buy a home of this value you would need to pay a deposit then obtain a mortgage for the remaining balance on the property.

How much is the deposit on a home?

In his March 2021 Budget, Chancellor Rishi Sunak introduced the 95% mortgage scheme. This will run until December 2022. It means that homebuyers are now able to pay just 5% deposit on their home, and use a mortgage (if eligible) to make up the rest of the cost.

The 5% deposit is more affordable than previous deposits of 10% – or even 15% – being demanded by lenders. For example, the table below shows the difference between 5% / 10% / 15% deposits on a property of the average UK price of £255,535.

| Deposit needed for a home costing £255,535 | |

| 5% deposit | £12,777 |

| 10% deposit | £25,555 |

| 15% deposit | £38.330 |

Whilst the 5% deposit of £12,777 is still a large sum of money, as you can see from the above figures, it is much more achievable than a 10% or 15% deposit.

So if you are hoping to buy your own home, it makes a lot of financial sense to try and do this before the end of December 2022.

What about other costs?

There are two other costs to consider when buying a home. Stamp duty and removal costs.

Stamp duty

Stamp duty is a tax that is paid on the purchase of a property in England and Northern Ireland. The good news is that as a first time buyer, you would pay no stamp duty at all on the first £300,000 of a property, and 5% stamp duty on anything between £300,000 and £500,000.

Removal costs

Depending on the distance of your move and the amount of stuff that you need to move, you may decide to use a professional removals company. Costs vary enormously, but you can expect to pay a few hundred pounds; more if you want the company to pack for you and/or dismantle and reassemble furniture. Removal costs often have to be paid in advance, so you need to allow for these costs if you plan to use a professional removals company.

But even if you do manage to save the money for a deposit and any other costs, can you be sure that you will be able to get a mortgage? Let’s take a look . . . .

Are you eligible for a mortgage?

If you are hoping to be able to get one of the 95% mortgages by December 2022, you need to be aware of the eligibility criteria for these mortgages, as well as the general credit and affordability checks used by most mortgage lenders.

Eligibility criteria for 95% mortgages

The three main conditions that you need to fulfil in order to be eligible for a 95% mortgage are:

- The property you are buying needs to be your main residence. You will not be able to get a 95% mortgage if you want to buy either a second property or a buy-to-let property.

- The value of the property you want to buy has to be less than £600,000.

- The mortgage you are applying for has to be a repayment mortgage. Any other type of mortgage – for example an interest-only mortgage – is not included in the 95% mortgage scheme.

General mortgage credit and affordability checks

As well as the specific eligibility criteria for the 95% mortgages, most mortgage lenders will also use general credit and affordability checks. They do this to make sure that you will be able to afford the mortgage repayments and that they are not taking a risk by lending to you.

As part of these checks, a potential mortgage lender will need information about:

Your employment status and income;

- Your monthly outgoings and current debts;

- Your credit history and current credit score;

- The amount of money you want to borrow.

If you plan to apply for a mortgage in the near future, it is a good idea to work on any of the above areas that may need attention. It is much better to take the time now to deal with any issues that may impact on your eligibility for a mortgage, rather than risk being rejected further downstream.

How to improve your chances of being accepted for a mortgage

There are four key things that you can do to increase your chances of being accepted for a mortgage:

1. Get hold of a copy of your credit report. You can do this through one of the main three Credit Reference Agencies (CRAs) in the UK: Experian, Equifax and TransUnion.

- – Check it carefully for errors such as incorrect details such as name, address or date of birth. According to research by Which? Money, around half the adult population never check their credit report, but around 20% of credit reports do have mistakes in them.

- – So check carefully and let the CRA know if there are errors that need to be fixed.

2. If your credit score is lower than you would like, do whatever you can to increase it. Five easy ways to do this are:

- – Ensure that you are on the electoral roll at your current address. You can register on the Gov UK website. This provides important evidence that you are who you say you are.

- – Check that you are not shown on your report as having financial links to anyone if this is no longer the case. For example a previous joint bank account or loan. Errors like this can lower your credit score if the other individual has a poor credit score.

- – Make sure that you manage any existing loans and credit cards well. This is good evidence to other lenders that you are a responsible borrower.

- – Also pay all your other bills promptly, for example phone bills and household bills. Late payments – however small – can impact your credit score.

- – Try to reduce your overall level of debt. Most lenders are concerned if you are already close to all your current credit limits, If possible, try to only use up to around 25% of your current available credit.

3. Increase your income if at all possible. The higher your regular income, the more attractive you will be to a lender and the more you will be able to borrow. So if this is an issue, perhaps it’s time to consider either a job change or the possibility of taking on some extra work as well.

4. Begin to budget and monitor your spending if you are not already doing so. Most mortgage lenders will require a detailed breakdown of your monthly living expenses and other outgoings. This is to help them decide whether you would be able to afford mortgage repayments. The more confident you are about how well you manage your money, and the more evidence you can show them that the mortgage is affordable, the better your chances are of being accepted.

How much will you be able to borrow?

Before you start looking for your new home, you need to have a realistic idea of how much you will be able to pay for your home i.e. your deposit and mortgage combined.

The amount you will be able to borrow on a mortgage will depend on your individual circumstances. Many mortgage lenders will potentially lend you around 4 times your salary, or joint salaries if you are applying with another person. Some may lend even more.

But it will all be subject to the above mortgage credit and affordability checks.

To get an idea of how much you may be able to borrow, check out the MoneySupermarket Mortgage Calculator.

How to get a good mortgage deal

Once you have a realistic idea of how much you could potentially borrow, where is the best place to start looking for a mortgage?

Not only do you need a mortgage that covers the cost of your new home, but you also need to check that you are getting a competitive rate of interest to keep your payments as low as possible.

You may also want to go for a fixed rate deal that will keep your interest rates and payments at the same level for a pre-agreed period of time whatever else is happening in the economy. The alternative is a variable rate which means that your mortgage payments could go either up or down, depending what is happening to interest rates.

You can also choose the length of the repayment period of your mortgage. The average mortgage repayment period tends to be 25 years, although longer term mortgages – 30-35 years have been steadily growing over the last few years. The longer your mortgage repayment period, the smaller your monthly repayments will be: but on the other hand you will end up paying a lot more interest on your mortgage overall.

But in many cases, a mortgage will cost less than what you are currently paying on rent!

For example, if you were to buy a home at the average price of £255,535 with a minimum 5% deposit of £12,777, you would need a mortgage of £242,758. Typical monthly repayments on this size of mortgage would be around:

- £1050 for a repayment period of 25 years.

- £920 for a repayment period of 30 years.

- £830 for a repayment period of 35 years.

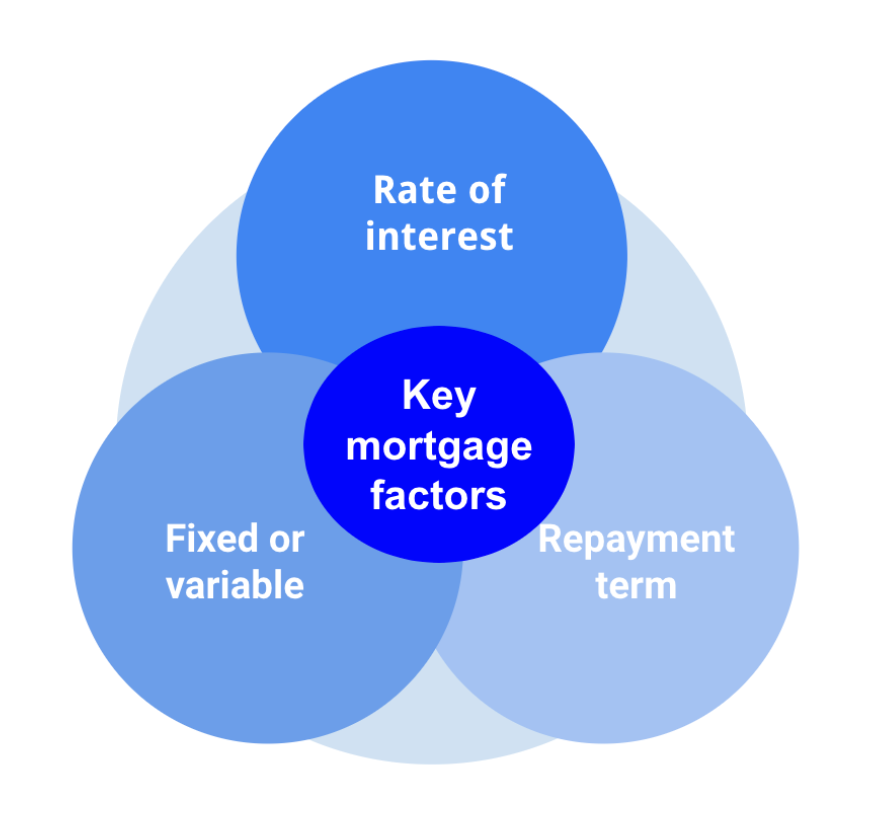

So, when looking for a good mortgage deal you need to take into consideration:

- The rate of interest.

- Whether the mortgage rate is fixed or variable.

- The length of the repayment term.

There are three ways that you could go about finding a mortgage:

1. Comparison websites

There are various websites that enable you to compare mortgage deals from a number of different lenders. For example MoneySupermarket Mortgage Calculator. By using a tool such as the mortgage calculator you will be able to see how much your monthly mortgage repayments will be, depending on the factors we explored above.

2. A mortgage broker

It can be helpful to use a mortgage broker to help you find good deals that you are likely to be accepted for. Some mortgage brokers also have access to exclusive deals that may not be visible to you as a consumer. Many online mortgage brokers do not charge for their services, for example Habito and London & Country. You may also want to check out local brokers through websites such as Unbiased or VouchedFor.

3. Go direct to your lender(s) of choice

If you have done some careful research you may have narrowed down your choice of mortgage to one or two lenders, perhaps a bank or building society where you already have an account. If this is the case you could approach them directly to discuss what they may be prepared to lend you, and what is the best deal they can offer you.

If, after reading the above, you don’t think you will be able to raise a deposit and/or qualify for a mortgage, there are still other ways that you can buy your own home.

Let’s take a look at three possible options.

Government schemes to help you buy a home

Help to Buy Equity Loan

This government scheme, available only in England until March 2023, does still require you to have a 5% deposit. It applies if you buy a new build property from a homebuilder registered for the Help to Buy Equity Loan scheme. The scheme enables you to have full ownership of a home.

As well as the 5% deposit, you will need to obtain a mortgage for 75% of the value of the property (55% in London). The remaining 20% of the cost of the property (40% in London) will be paid by a government loan that is interest-free for the first five years. After five years you will be charged 1.75% on the remaining amount as interest. You can repay all or part of the equity loan at any stage, but do not have to do this until you either sell your home or have lived in it for 25 years.

To find out more, you can contact a Help to Buy agent in your area.

Shared ownership

If you can’t currently afford to buy a new home, shared ownership can enable you to buy a share of a property, usually between 10% and 75%. You own this portion of the property and pay rent on the rest. You can then gradually increase your share of the property until you own it 100%.

Shared ownership is available to households with an annual income of less than £80,000 (£90,000 a in London) and if you are either a first-time buyer, used to own a home but can’t now afford to buy one, or are an existing shared owner looking to move. The scheme applies to some newly built homes and also some existing homes through resale programmes from housing associations.

To find out more, you can contact a Help to Buy agent, as above.

Right to Buy

If you are currently a council tenant, you may be eligible to buy your existing home at a discount under the Right to Buy scheme. The amount of the discount depends on the type and location of the property. You can find out from the Right to Buy website whether you are eligible for the scheme.

So if you are currently renting a home and would like to buy, there is no time like the present. Why not take advantage of either the 95% mortgages or government support schemes and make 2022 the year when you achieve your dream of owning your own home; at last.

Personal loans | 18 or 24 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Confidential &

secure