How to make your money work better for you!

Financial goals.

Do you live to work or work to live?

There are times in our lives when all we seem to do is work.

We put in all the hours we can to try and meet our financial goals, whether that is saving for a home, holiday or car, getting ourselves out of debt, or just trying to get our daily finances back on track.

So as we approach the later years of our working lives, it seems only fair that things should change for the better. It’s time to make our money work for us rather than our whole life being taken up with working to make that money.

However far you are from retirement, this paper will look at ways that you can make your money work better for you.

Making the most of your last years of employment

If you are still employed you may be longing to retire. You dream of leisurely days, getting up when you feel like it and then doing whatever you want to. Perhaps you are looking forward to seeing more of your family and friends, doing some travelling, spending more time on a hobby or interest or even getting a pet.

But however long it is until you are able to retire, you have the opportunity to use that time to make your retirement as financially comfortable as you can. Recent research by The Pensions and Lifetime Savings Association, in conjunction with Loughborough University, has resulted in a set of Retirement Living Standards.

Retirement Living Standards

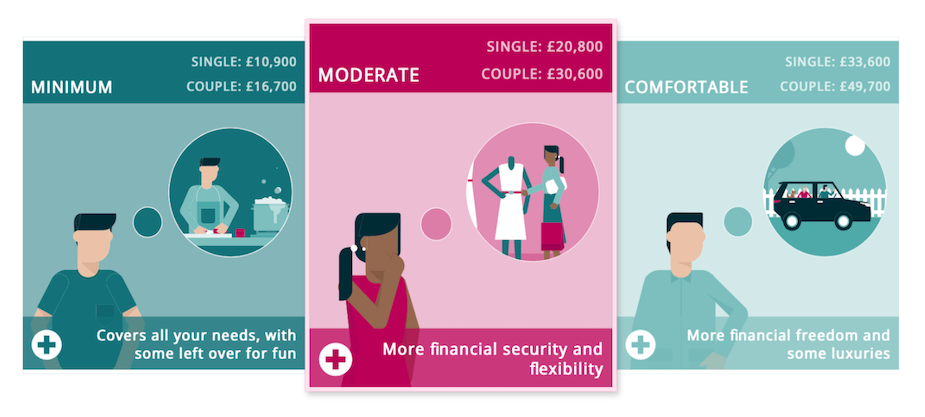

- The Retirement Living Standards indicate how much annual income you would need in retirement for the kind of lifestyle you hope to have.

As you can see from the image above – courtesy of The Pensions and Lifetime Savings Association – you would need an estimated £10900 net of tax as a single person, or £16700 as a couple, for what they describe as a Minimum lifestyle.

It is important to realise that this is based on the assumption that you are a homeowner who has paid off your mortgage, so no mortgage or rent is included in these figures. They also do not include a car. But they do include:

- General home maintenance and redecorating one room a year;

- A weekly food shop of around £41;

- A week and a long weekend in the UK every year;

- £410 for clothing and footwear each year;

- £10 for each birthday present.

The above figures increase for the Moderate and Comfortable Retirement Living Standards, as does the estimated annual income needed to sustain them.

The full state pension is currently £179.60 per week, before tax, which equates to an annual income of £9339.20. The actual amount you receive is dependent on your National Insurance record, which you can check by entering your details on the Gov UK State Pension forecast tool.

However, it is clear that you are going to need some additional income over and above the state pension in order to have the kind of retirement that you are dreaming of. We will now look at three ways to do this.

Three ways towards financial freedom in retirement

Top up your pension pot

Whilst there is no legal retirement age in the UK, there is a set age at which you will receive your state pension. This is currently 66 for both men and women, but will rise to 67 between 2026 and 2028 and even further to 68 between 2037 and 2039.

This means that at whatever age you decide to retire from employment, you will not get your state pension until you are aged 66 or even higher.

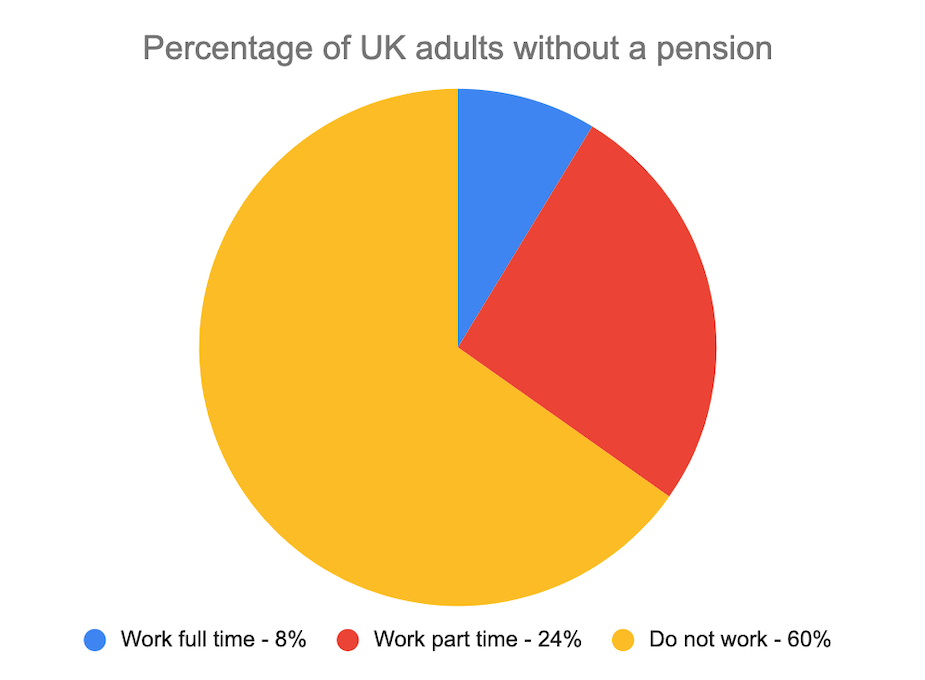

So for flexibility over when you retire, as well as the amount of money you will receive, it is well worth having an extra pension. Unfortunately, many people in the UK do not yet have any other pension, as can be seen from the chart below.

The good news is that it is never too late to start topping up your pension pot. So no matter how few years in employment you may have ahead of you, there is still something that you can do.

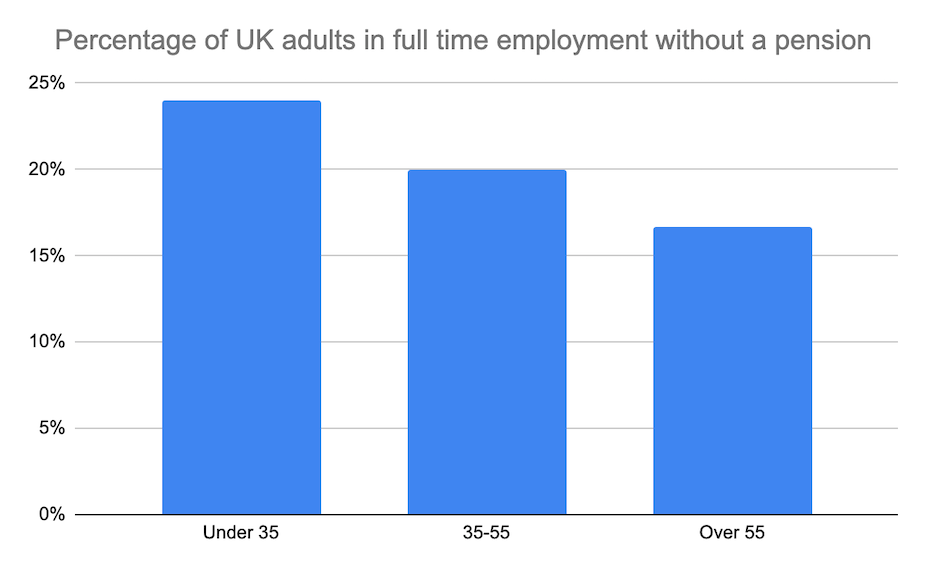

As we can see from the chart below, there is a big difference in the numbers of UK adults in full time employment saving into a pension between different age groups.

It is never too late to start an extra pension. If you have another pension you may be able to retire from aged 55 onwards.

The main two types of extra pension are either a work pension or a private pension:

Work pension

Since 2018, all employers in the UK have been legally required to automatically enrol you in a workplace pension scheme if you earn more than £10,000 per year and are aged between 22 and state pension age. Many larger companies were obliged to do this from 2012.

If you are not sure whether or not you are part of a work pension scheme, make it a priority to discuss this with your employer.

In a work pension scheme, your employer will contribute money into the scheme, and you can also make extra payments into it. These payments will usually attract tax relief, which means that you pay less tax overall.

Private pension

You can choose to set up a private or personal pension whether or not you are in a work pension scheme. You can make payments either on a regular basis or by a lump sum. As with the work pension, your payments will usually be eligible for tax relief.

Most private pensions can be accessed from age 55, though this may rise to 57 by 2028. You are able to withdraw up to 25% of the pension’s value as a tax-free cash lump sum. The remainder of the fund can either be left in the fund to provide regular or occasional income, or can be used to buy an annuity, which could provide you a guaranteed income for life.

Increase your savings

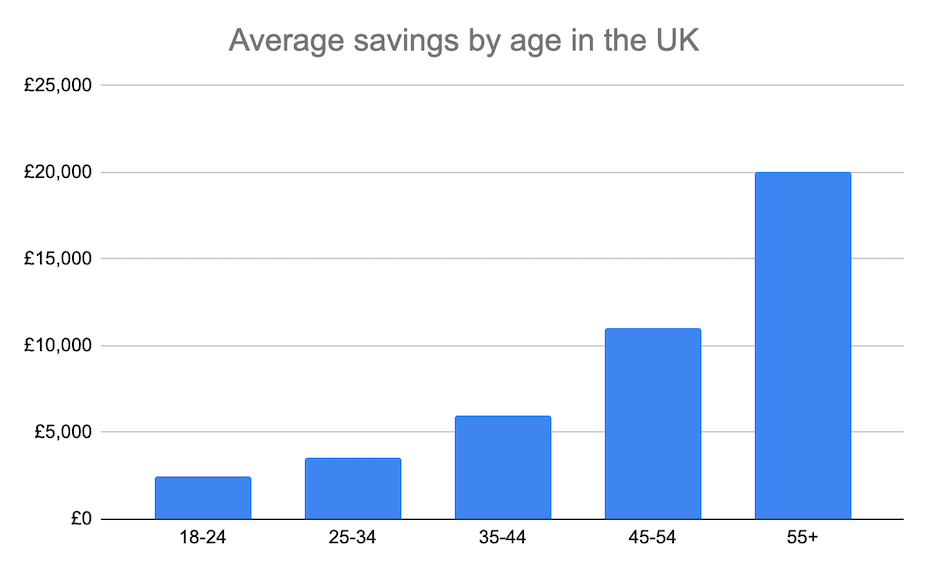

Around 26% of adults in the UK have less than £500 savings, and 13% have no savings at all. However, of those who do have savings, the average amount of those savings rises with age to around £20,000 for those aged 55 and over.

If you do have savings of around this amount, you already have a healthy buffer with which to start your retirement. But if not, just like pensions, it is never too late to start saving. Contributing to an extra pension is one excellent way of saving, but there are other ways too.

Here are five ways that you may be able to build up your savings:

Savings account

As soon as you can, set up a monthly standing order to pay money regularly into a savings account. Even if it is only a small amount, it will be a start.

Ideally try to find a fixed term savings account as the interest rate may be a little higher. It will also lock your money away for a while to prevent you taking it back out of savings again.

ISA and LISA

An ISA – Individual Savings Account – enables you to save up to £20,000 a year and pay no tax on any interest. Most banks and other financial institutions offer ISAs, so it is quite straightforward to find and apply for an ISA either in a branch or online.

The two main types of ISA are cash ISAs and stocks and shares ISAs. If you are under 40, you are also eligible for a Lifetime ISA (LISA) which enables you to save up to £4,000 each year and benefit from a 25% bonus from the government every year until you reach the age of 50. You can only withdraw your money from a LISA for specific reasons, which include reaching the age of 60: perfect for a boost to your retirement income.

Stocks and shares

We’ve just referred to a stocks and shares ISA. This invests your money in stocks and shares which means that it is more risky than a cash ISA because the value could go down as well as up. But this also means that it’s possible to get a much higher rate of return from a stocks and shares ISA than a cash ISA, if you are prepared to leave your money in it longer term.

You can also invest in stocks and shares yourself by setting up a share dealing account either through your bank or with an online share dealing platform such as Hargreaves Lansdown, eToro or IG. Again, be aware that values can fall as well as rise, and so it is better to take a long term approach if you plan to try investing in stocks and shares.

Gilts

Gilts are government bonds. You effectively loan money to the government for a fixed period of time, and in return you are paid a fixed amount of interest each year until the bond reaches its maturity date.

To invest in gilts you can either:

- – buy them at the time of issue from the government’s Debt Management Office. You would first need to apply and register with Computershare Investor Services, and be accepted onto the Approved Group of Investors.

- – buy them second hand through a stockbroker or investment platforms such as those mentioned earlier.

Premium bonds

Premium bonds are another popular way of saving, and if you are lucky they can return around 1% of the value of your savings. This rate of return is not guaranteed, but your bond numbers will be entered into a monthly prize draw, with tax-free prizes of between £25 and £1million.

Premium bonds can be bought online from NS&I (National Savings and Investments) in multiples of £25 and can be cashed in at any time.

Pay off your mortgage and other debts

The third way that you can make your money work better for you in preparation for retirement is to clear your debts. The largest debt for many people is your mortgage. We saw earlier that the Minimum Retirement Living Standard requires an annual net income of £10900, and this amount does not include any cost of mortgage or rent.

So for your remaining time in employment, it makes a great deal of financial sense to do all that you can to pay off your mortgage and also clear as many other debts as possible.

Pay off your mortgage

Paying off your mortgage can understandably seem like a huge – if not impossible – hurdle to overcome. But even small overpayments into your mortgage on either a regular or occasional basis can start to make a difference in the amount you still need to repay and the time it will take you to do so.

Overpaying into your mortgage not only reduces the amount of the original mortgage that you need to repay, but also the overall amount of interest on that amount. These changes could enable you to pay off your mortgage earlier than originally planned, perhaps even by years.

Take a look at the free Mortgage Overpayment Calculator from Money Saving Expert to see just how much difference occasional or regular overpayments could make.

Pay off other debts

You will be in a much stronger financial position in retirement if you are not carrying debt with you. So draw up a plan to tackle your existing debts, and aim not to take on any further debt.

If you already have some savings it could make sense to use some of them to start paying off debts such as credit cards and loans. Interest rates for savers are low and your money could potentially work harder by paying off debt rather than sitting in a bank account. And once you are freed up from regular debt repayments you will have that money available to save.

If you have several debts you may want to work towards paying off the most expensive one first, to save on interest charges. Another option is to get rid of the smallest debt first so that you have achieved something positive, then channel your regular repayment for that debt into the next one on your list.

If you keep up your repayments on all your debts but focus on getting rid of one completely by throwing everything you can at it you will soon start to see a difference. And just think how good it would be to be rid of them all by the time you retire.

In this paper we have explored the kind of income you will need in retirement and outlined various different ways that you may be able to achieve that.

We hope that the information is helpful and will enable you to start making your money work better for you as you look forward to the retirement you deserve.

Personal loans | 18 or 24 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Confidential &

secure