We’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

We use cookies to improve your experience on our websites and to analyse how and when our sites are used. By clicking 'Accept all & continue' you're agreeing to our use of cookies. To learn more about the cookies we use, you can read our cookie policy.

Opt out of non-essential cookiesWe’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

Oct 16, 2025

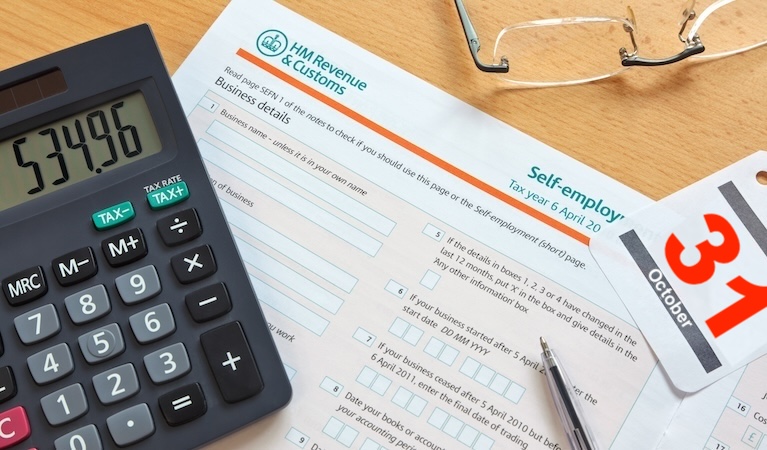

If you are self-employed you will know only too well that you need to submit a tax return. But did you know that you may also need to do this if you earn money from any kind of side hustle in addition to your regular job? Or if you have savings or other sources of income above a certain amount?

In this article we explain:

HMRC guidelines state that you need to complete a tax return if you worked for yourself between 6 April 2024 and 5 April 2025 and earned more than £1000 through this. Working for yourself could be either as a sole trader, business partner or director of a limited company. This applies even if you had another job as well.

You may also need to fill in a tax return if you have any untaxed income from other sources. For example:

If you do need to fill in a tax return, this can be done either via a paper form or online. Paper tax returns for 2024/2025 need to be completed and returned to HMRC by 31st October 2025, and online returns by 31st January 2026.

Filling in a tax return can feel quite daunting, and most of us just want to get it over and done with. But it’s worth taking a bit of extra time to check that you are paying the correct amount of tax. Mistakes can be rectified later on, but it’s better to get everything right first time and avoid any delay in getting money back that is owed to you.

Three things to look at carefully whilst completing your tax return are:

Every UK tax payer is allocated a tax code by HMRC which indicates how much you can earn before having to pay tax. The code is a series of letters and numbers, and for most people it will be 1257L. This is based on the current UK tax free allowance of £12570.

If your tax code is 1257L it means that any income up to £12570 is not taxed, but if income exceeds £12570 it is subject to tax, initially at the rate of 20%. However, if your income were to exceed £50,270 you would be taxed at 40% for any income over that amount.

Mistakes can happen, so if your code is different from what you are expecting, contact HMRC on 0300 200 3300 or via online chat to check that it is correct.

If you earn less than the current personal tax allowance of £12570 and are living with a husband, wife or civil partner who earns more than you, you could use the Marriage Allowance to transfer up to £1,260 of your personal tax allowance to them. This would reduce their tax for the year by up to £252.

To find out more details on how to do this, check out the Gov UK website.

If you are self-employed or a private landlord you can deduct various expenses from your gross income before you pay tax on it. This means that your income is reduced so the amount of tax you have to pay on it is less.

Expenses for the self-employed include travel, home office expenses, insurance, stationery, marketing costs and staff training. Also, if you work from home, you can also claim a percentage of household bills such as energy and internet costs.

You may also be able to take advantage of capital allowances if you need to make major purchases for your business such as vehicles or computers.

If you are a private landlord you can deduct expenses such as agent fees, legal fees, maintenance and repairs, and administrative costs such as phone bills, stationery and advertising.

For more details on all the above, check out the Gov UK website.

Looking ahead to the rest of the 2025/2026 tax year and onwards to 2026/2027, make it your mission to start finding ways to reduce the amount of tax you need to pay.

As well as the three factors mentioned above, there are two other things that can help you to do this.

Whatever age you are, if you have an occupational or private pension, you can start making it work harder for you. Most occupational and private pensions enable you to make additional contributions into your pension on either a regular or occasional basis. You may not think you can afford to do this but, as well as increasing the value of your pension, it can actually save you money on tax.

All pension contributions are deducted from your gross income i.e. your income before tax. So, for example, if you contribute an extra £1,000 to your pension during a tax year, your taxable income decreases by £1,000. If you pay tax at 20% this means that you would pay £200 less in tax, so your £1000 savings in reality costs you £800.

If you have enough savings to earn interest over your £1000 per year Personal Savings Allowance, it’s worth looking for alternative places to save. There are savings accounts such as ISAs that allow you to earn interest without paying tax on it. Another option could be Premium Bonds where there is no set rate of interest but you can win tax free prizes in their monthly draws. Or if you can lock your money away for longer and you may want to consider investing in shares as the dividends from these are also tax free.

We hope that the above tips help you to understand more about whether you need to complete a tax return, how to check whether you are paying the correct amount of tax, and how to pay less tax in future.

If at any stage you need a financial boost to get your tax situation sorted, remember that Loans 2 Go offer a range of personal loans which may be able to help. Full details, including terms and conditions are available on our website. Borrowing is optional and may not be suitable for everyone, so always consider your circumstances and affordability before applying.

For more useful financial and lifestyle tips, visit us here again soon at Loans 2 Go.

Loans 2 Go is a trading name of Loans 2 Go Limited, registered in England and Wales (company number 4519020). Loans 2 Go Limited is authorised and regulated by the Financial Conduct Authority (Firm reference number 679836). ICO registration number Z720743X. Registered office: Bridge Studios, 34a Deodar Road, London SW15 2NN.

Our lending products are regulated consumer credit agreements under the Consumer Credit Act 1974 and are not structured as short-term single-repayment credit facilities. Loan funds are paid by bank transfer once your application has been approved, subject to our working hours: Monday to Friday, 8am to 8pm, and Saturday, 8am to 5pm. All loans are subject to eligibility and affordability checks. The maximum APR offered is 815.6%. Loan repayment periods range from a minimum of 18 months to a maximum of 24 months.

As a lender, we may pay commission to credit brokers or other intermediaries who introduce customers to us. The amount of commission varies depending on the broker, the product offered and the terms agreed. This commission is paid by us and does not affect the interest rate, terms or total amount payable under your loan agreement.

© 2026 Loans 2 Go. All rights reserved.