Is it time for a major lifestyle change?

Wake up call!

Life changing opportunities

The Covid pandemic has been life changing for so many people.

Some have been very ill with the virus or have sadly lost loved ones to it. Others have lost their jobs. Education, healthcare and general everyday living and socialising have been completely disrupted. Not to mention delays or cancellations of significant life events such as weddings…

All the above factors have come as something of a wake up call.

Taking enforced time away from our normal frenetic level of activity has led many of us to reflect on what is really important in life. And as things gradually begin to return to some semblance of normality, the key issue is whether we do want to go back to the way things were pre-Covid. Or is it time for a major lifestyle change?

In the first part of this paper we look at some of the ways that people are changing their lives post-Covid. In the second we explore the big issue that many of us feel prevents us making positive changes: lack of money.

How would you want to change your life?

Wanting to change the direction of your life is nothing new. The term “midlife crisis” is a very familiar one. But the desire to reinvent your life can strike well before the onset of middle age, especially when triggered by circumstances beyond our control, such as the pandemic.

During the pandemic, the ONS (Office for National Statistics) has conducted an Opinions and Lifestyle survey to provide weekly reports about how Covid-19 has been affecting their lives. Since March 2020, over 200,000 adults in the UK have taken part in this survey.

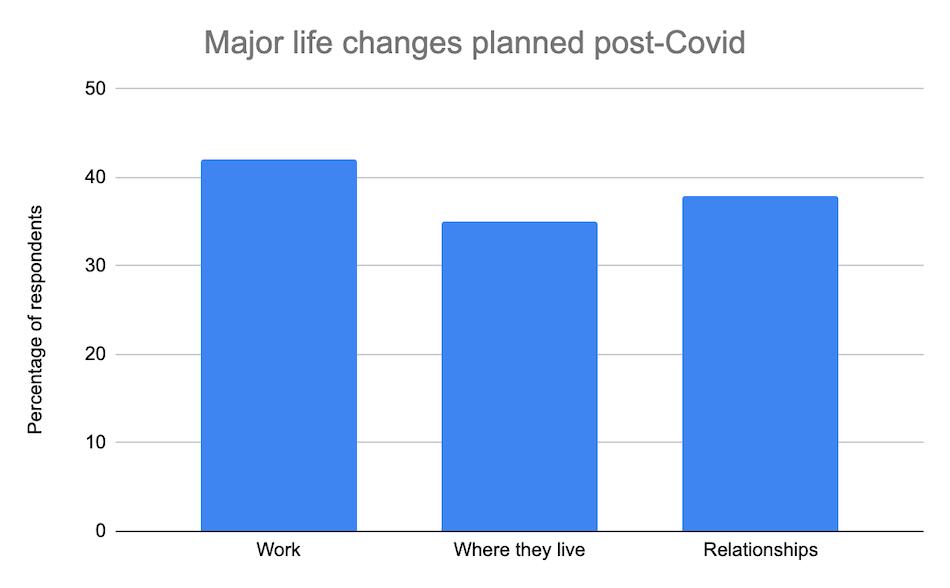

In June 2020, there were three significant areas in which people wanted to change their lives for the better after the pandemic:

- Work

- Where they live

- Relationships

Let’s take a look at some of the ways in which people want to change those areas of their lives, and how to go about doing it.

How to make changes to your work and career

Some job changes have become necessary due to the impact of the pandemic. Others are a conscious decision, but as we have seen may also be heavily influenced by the pandemic.

A survey by Aviva of 4,000 workers by Aviva found that 60% of them planned to make career changes as a result of the pandemic. For some, this will be doing a similar job for a different employer, some it will mean retraining to do something new, and yet others may decide to set up their own business.

Changing employers

If you have either continued to work your normal hours during lockdown, or have been furloughed and/or worked reduced hours, you may have come to realise that you are completely bored in your current job. Yes, it’s a job and you’re grateful to have it. But perhaps it’s time to spread your wings?

The financial impact of the pandemic may also motivate you to seek a job that has better pay and benefits than where you are at the moment. A job that will enhance every aspect of your wellbeing.

As the economy starts up again, the expectation that home working will continue to be offered by many organisations can open up a new world of job opportunities to you.

Retraining

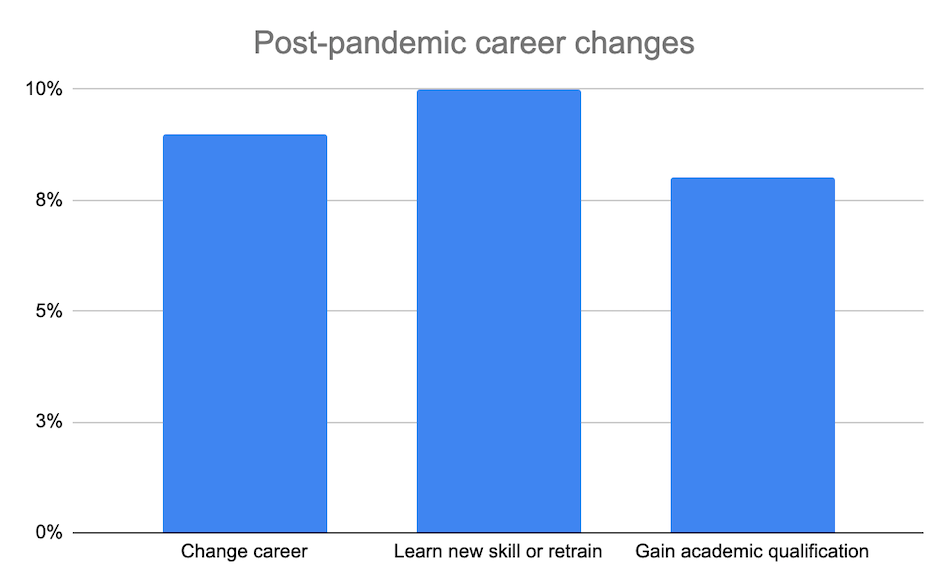

The Aviva survey referred to above indicated that post-pandemic:

- – 9% of workers wanted to change career;

- – 10% planned to learn a new skill or retrain;

- – 8% planned to gain an academic qualification.

So if you have the desire to perk up your career, gain further qualifications or retrain altogether, you are by no means alone.

But an emerging trend is the number of people who no longer want to work for others. They want to be their own boss.

Setting up your own business

Post-pandemic an estimated 12% of people are now considering turning a hobby into a career. In fact, even during 2020 – despite the pandemic – there was an increasing number of start-up businesses. Over 400,000 businesses were launched during this period.

Many people had the opportunity to consider entrepreneurship for the first time, and set up businesses that used their hobbies and passions to generate income.

The key message from this is that if you have a skill, talent, or business idea it is worth pursuing the possibility of making money from it. If that is your dream, perhaps it’s time to make it happen?

How to decide on the best place to live

Live wherever you like

Another major post-pandemic lifestyle change being considered by many is to change where they live. For some this may be moving home within their current area. For others it is a complete relocation to a different area altogether.

The continuation of remote working in many jobs has opened up a wide range of possibilities for where people can live. Whether this is a complete escape to the country, or a move not far from where you are now but slightly less commutable to the office, the choice is yours.

According to the property site Rightmove, Cornwall is now the most searched for location, pushing London into second place. Devon is third, and at 10th place – up from 20th – is Dorset.

| Top search locations 2020 | Top search locations 2021 |

| London | Cornwall |

| Cornwall | London |

| Devon | Devon |

| Bristol | Bristol |

| Glasgow | Glasgow |

| York | Edinburgh |

| Edinburgh | Sheffield |

| Sheffield | York |

| Manchester | Manchester |

| Cambridge | Dorset |

As well as hopefully being able to move to somewhere with a bit more space, another advantage of having greater choice over where you live is the potential improvement in work-life balance. Without the time and hassle of a daily commute, it can be easier to juggle child care and other family commitments. It also frees up more time for keeping fit, which many people began to take up more seriously during lockdown.

Make a positive decision whether to buy or rent

Another life-changing decision to make is whether to buy or rent your home. Recent policy changes such as 95% mortgages and the Help to Buy Home Equity scheme are making it more possible than previously to achieve home ownership if you want to do this.

Conversely some lifestyle changers may be considering selling their home either to become a cash buyer further downstream or to release funds for other things that they want to do in life.

Whatever choice you make, ensure that you take into account all relevant factors so that you make the best decision for you and your family in these changing times.

How to make the best relationship choices

Relationships are another major area of life that many people want to improve post-pandemic. The long months of isolation made many of us realise how important family and friends are, and how much we can take those relationships for granted.

The two main lifestyle changes that people want to make here are:

Put family first

We’ve already referred to work-life balance. During lockdown things became very skewed for many families: being cooped up together all day and every day. It was very tough for some people. Yet at the same time, many families valued the opportunity to spend time together and rediscover the fact that you actually enjoy each other’s company most of the time.

So there is considerable reluctance to slip back into the frantic level of activity that so many of us had before the pandemic. Finding a more balanced way forward, and being a significant part of your family’s life again is now much more of a priority for many people than it was before.

You may even decide that the time is right to expand your family. If you would like children but don’t yet have them, or have children but would love more, the return to more normal times could be an ideal opportunity to make that happen.

Spend more time with others that are important to us

So many activities and events with family and friends ground to a halt during lockdown. Now that restrictions are eased, it’s the ideal time to catch up with everyone you want to see. We used to take it for granted that we could just go and visit family and friends both near and far whenever we wanted to. But the pandemic restrictions put paid to that. As Joni Mitchell’s Big Yellow Taxi reminds us, “You don’t know what you got ’til it’s gone”.

Many people are feeling the need, post-lockdown, to spend more quality time with family and friends. This can link into the desire to live somewhere else, perhaps to be nearer elderly relatives or to have more space in your new home for friends and relatives to visit regularly.

Whatever your desires for improved relationships post-pandemic, try to ensure that you don’t lose impetus. Instead, start making lifestyle changes that make you happier.

How can you finance a major lifestyle change?

If any of the above resonates with you, perhaps it really is time for that major lifestyle change that you have dreamed of. But what about the financial side of things? How can you finance a major lifestyle change?

We will look at two ways forward here: current and future.

- How can you make the most of your current finances to give you more flexibility in your lifestyle?

- If a lifestyle change is simply not possible right now, what can you do to make it happen within the next few years?

Make the most of your current finances

If you are planning to make some lifestyle changes, one of the key things to do is take a detailed look at your finances. Are they able to withstand changing jobs or moving home, both of which could put a strain on your finances in the short term, even if they then result in you being in a stronger financial position.

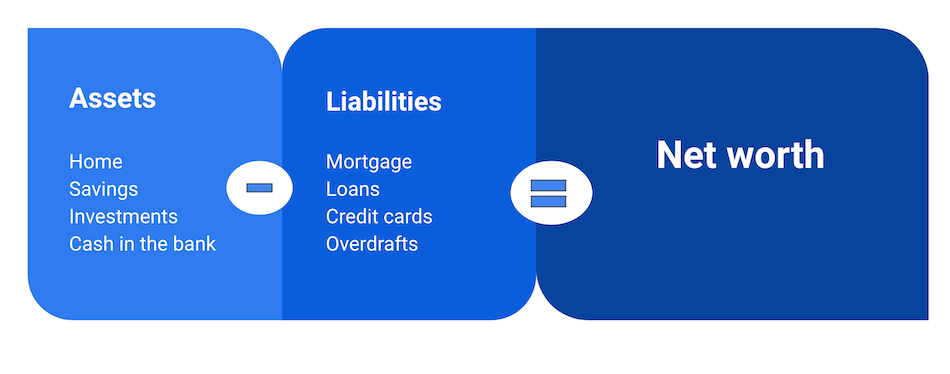

So take the time to have a thorough look at all aspects of your finances. Start by doing a calculation of your overall net worth. This is the relationship between your assets: everything you own, and your liabilities: everything you owe.

The aim is to work towards having a positive net worth if you don’t already. This is a good overall indicator that your finances are in a healthy position. You also need to keep a close eye on all the significant aspects of your personal finances, ie:

- Monthly budget: income and expenditure

- Level of debt

- Credit score

- Savings

- Pensions

From exploring these aspects of your finances it should become clear whether you are in a position to make some of your desired lifestyle changes now, or whether you need a bit more time to work towards them.

Build up your future finances

If you don’t have the finances to make major changes at this point in time, the next thing to do is make a longer term plan to raise the money you are going to need.

We listed five key areas above, and will look briefly at each of these in turn:

Monthly budget: income and expenditure

It is essential to get a clear idea of how much money is coming in every month, and how it is being used. So, keeping track of your income and expenditure is the first step to getting to grips with your ongoing financial situation. Once you see where the money is going, you can decide whether you need to increase your income, change your spending habits, or both.

Level of debt

Your aim should be not to use more than around 25% of your overall available credit. Ideally try not to let debt mount up as it can so easily spiral out of control. Debt drags you down, and drains your finances, so if you realise that your current level of debt is too high, this needs to be a priority for you to sort out.

This may require you to take on extra work, bring in a lodger, sell assets such as your car. The higher your debt, the more drastic may be the action you need to take to tackle it, but it will be worth it to become debt-free and look forward to a brighter financial future.

Credit score

Closely linked to the debt issue is your current credit score. You can find out your credit score from one of the three main Credit Reference Agencies (CRAs) in the UK – Experian, Equifax or TransUnion.

It’s important to get your credit score as high as it can be. Not only does a poor credit score make it less likely for you to get approved for loans or other credit, it can also impact other financial aspects of your life such as mobile phone contracts or rental agreements.

Savings

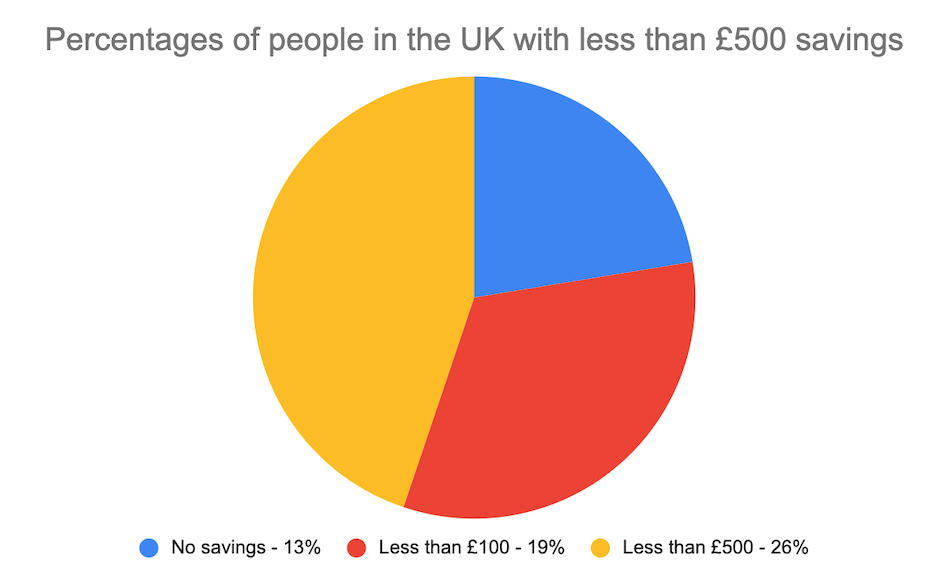

If you have very little savings you are not alone. Recent research by the Yorkshire Building Society revealed that 26% of adults in the UK have less than £500 in savings, and 13% have no savings at all.

The good news is that it’s never too late to start saving. When you look at your finances it can sometimes feel as if there’s no way you will ever save money but the best way is just to get on with it.

Start by opening a savings account and setting up a direct debit for a very small amount every month. This may mean that you have to make sacrifices in other areas of your life, but try to see it as an exciting new challenge to be overcome rather than an impossible scenario. Once you get used to that money going out of your account, you can gradually increase the amount whenever you are financially able to do so.

Also try to supplement your regular savings with extra deposits whenever you can. For example, bonuses, gifts or wins. It can also help to set savings goals for yourself then work out creative ways to meet them.

Pensions

If you only have the state pension, it is a good idea to get another pension plan in place. The state retirement age continues to increase, which means that it will be later before you can retire if that is all you have to depend on.

If your employer has a pension scheme make sure you are enrolled in it. If you are not, or are not sure, check with them as soon as possible. A good workplace pension scheme can be a real boost as your employer contributes money, usually at least 3% of your salary, into your pension. You may also be able to make extra contributions into it if you want to do so.

Another option is to take out a private pension and pay into it either on a regular or lump sum basis. The good news is that if you are paying extra into a work or private pension, your payments will normally be eligible for tax relief, which offsets part of the cost of your pension contributions.

Whatever major lifestyle change you dream of, it is possible for those dreams to become a reality. Whether that is now or a few years ahead, the more you plan for it and get your finances in order, the better it will be. So if you are feeling restless and ready for change, now could be the time to start making that happen.

Personal loans | 18 or 24 months

Life is full of ups and downs, and sometimes things just don’t go to plan.

£250 - £2,000

personal loans

Confidential &

secure