We’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

We use cookies to improve your experience on our websites and to analyse how and when our sites are used. By clicking 'Accept all & continue' you're agreeing to our use of cookies. To learn more about the cookies we use, you can read our cookie policy.

Opt out of non-essential cookiesWe’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

Feb 08, 2023

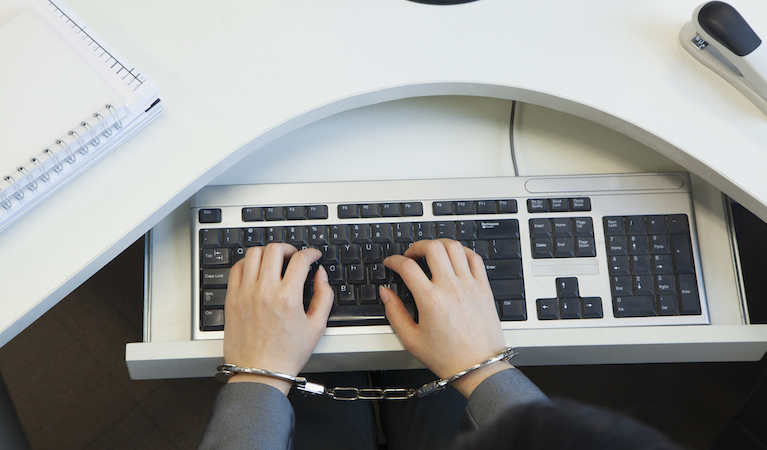

This article is part of Loans 2 Go’s mini series – Stop the Scammers! Our aim is to provide information about the kind of scams that exist in today’s digital age, and how to protect yourself from them.

You can also find more information about frauds and scams on our dedicated Recognising Frauds and Scams page.

In this article we explore how to recognise whether or not a business is genuine. If you receive a phone call, text, or letter supposedly from a business, how can you be sure it’s not a scam?

We are going to look at:

Many different types of business are misrepresented by scammers. Recently, the UK’s biggest fraud operation uncovered a major fraud website called iSpoof, which enabled scammers to pose as representatives of banks, tax offices and other official bodies in an attempt to defraud victims. It’s thought that around 10 million fraudulent calls were made globally via iSpoof, with around 3.5 million of these being made in the UK.

Unfortunately, iSpoof is not the only means by which scammers can impersonate a business. Some of the most common types of business to be misrepresented are:

The above scams will usually use either phone or text to contact their victims, but there are also other scams that tend to use email or post, such as communications about:

With so many scams around, it can seem impossible to know who to trust. But it’s always better to be safe rather than sorry, and a few simple guidelines can help you to differentiate good from bad. Here are five ways to spot a scam:

This is a good place to start. Scammers usually contact many different people at random, hoping that they will hit on some of the customers of the business they are impersonating. So if you get a call, text, or letter from a bank or other business you do not have an account with, you can immediately recognise it as a scam.

If the scammer does manage to get the correct name of a bank or business that you do use, ask yourself if you are expecting to hear from them? The scammer may say that your bank account has been compromised, or you have internet issues, or a parcel couldn’t be delivered. But unless you are already aware of this situation, treat it as a scam.

If there’s a small doubt in your mind that it may actually be genuine, contact the business yourself later on a number or email address you know to be correct.

If your bank or other official organisation does genuinely need to contact you, they may ask you a couple of security questions to make sure that it is you they are talking to, but they will not ask for detailed information such as your account numbers or passwords. So if you suspect someone on the phone is not whom they claim to be, hang up and contact the organisation directly. It is a good idea to wait for a while before doing this in case the scammer is still on the line.

If the caller claims to be from your bank, an alternative to this is to call 159, which will override any existing caller still on the line, and will put you directly through to your bank. Banks that use 159 include:

Scammers will play on your emotions to try and get you to comply. So, for example, if they are trying to get you urgently to transfer money (often for “security” reasons), or to respond to a time limited offer, or to convince you that your finances, health, family or home will be disadvantaged if you don’t follow their advice, it’s very likely to be a scam.

Most professional organisations will not use the above tactics even if they do contact you to discuss ways of improving their service to you.

As well as feeling rushed or panicked, alarm bells should definitely ring if you feel in any way threatened. For example, a very common scam over the last couple of years has been scammers impersonating HMRC saying that you would go to prison if you did not give them money immediately.

If you feel threatened or unsafe during any kind of scam call, make sure you hang up and seek help. If in doubt, call 999.

One of the best ways to report a scam business is to contact Citizens Advice. You can do this either online or by calling their consumer helpline on 0808 223 1133.

Explain clearly why you are suspicious and give them as much information as you can, for example:

If you have paid any money to what you now realise is a scam, report it to Action Fraud either online or by calling 0300 123 2040. It is also worth contacting your bank to see if the payment can either be stopped or traced.

We hope that the information in this article helps you to be more aware of how to recognise whether a business is genuine.

For more information about other types of scam, check out our Stop the Scammers! Series. You can also find more helpful information on our Recognising Frauds and Scams page we mentioned earlier.

Loans 2 Go is a trading name of Loans 2 Go Limited, registered in England and Wales (company number 4519020). Loans 2 Go Limited is authorised and regulated by the Financial Conduct Authority (Firm reference number 679836). ICO registration number Z720743X. Registered office: Bridge Studios, 34a Deodar Road, London SW15 2NN.

Our lending products are regulated consumer credit agreements under the Consumer Credit Act 1974 and are not structured as short-term single-repayment credit facilities. Loan funds are paid by bank transfer once your application has been approved, subject to our working hours: Monday to Friday, 8am to 8pm, and Saturday, 8am to 5pm. All loans are subject to eligibility and affordability checks. The maximum APR offered is 815.6%. Loan repayment periods range from a minimum of 18 months to a maximum of 24 months.

As a lender, we may pay commission to credit brokers or other intermediaries who introduce customers to us. The amount of commission varies depending on the broker, the product offered and the terms agreed. This commission is paid by us and does not affect the interest rate, terms or total amount payable under your loan agreement.

© 2026 Loans 2 Go. All rights reserved.