We’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

We use cookies to improve your experience on our websites and to analyse how and when our sites are used. By clicking 'Accept all & continue' you're agreeing to our use of cookies. To learn more about the cookies we use, you can read our cookie policy.

Opt out of non-essential cookiesWe’ll never ask you to pay us a fee before disbursing your loan. If affected, please contact us & learn more here.

Late repayment can cause you serious money problems. For independent help, please go to www.moneyhelper.org.uk

Nov 27, 2024

A few months ago we published a series of articles called Stop the Scammers. These covered issues such as mobile phone fraud, scam texts, phishing emails, fake websites and people impersonating businesses.

Sadly, the nature of scams changes all the time, so this is a topic that we will return to from time to time. But in this article we focus on recent legal changes designed to help victims of scams. These changes came into effect during October, and for 99% of scam victims the changes are good news.

Let’s take a look at some of the main impacts of the changes.

From the end of October banks have been given the power to pause payments for up to four days. Before this, bank transfers had to be either processed or declined by the end of the next working day. Even if the bank were to suspect the transaction may be fraudulent, they also faced pressure from customers who understandably wanted payments to be made instantly.

Extending the payment pause by three more days will give banks and payment providers more time to investigate fraud where they have reasonable grounds to suspect this to be the case. These grounds will include any unusual spending patterns or recipients. If the delay is implemented, banks will need to contact a customer to explain the situation, and either investigate further or receive confirmation from the customer before the money is transferred.

Concerns have been raised about this new power – for example in the case of a bank customer needing to make a one-off money transfer quickly as part of a home move – and there is the possibility of compensation if a payment delay means that a customer has to pay extra charges.

Before October, most High Street banks and payment companies had signed up to the Contingent Reimbursement Model (CRM). Under the CRM, they would voluntarily compensate customers who had been tricked into sending money to scammers.

However, the CRM has now been replaced by a Mandatory Reimbursement Requirement. This requires UK banks and other payment service providers to refund fraud victims up to a maximum of £85,000 within five days.

You should be covered by the new rules if you:

Also under the new rules, your bank or payment service provider will be able to claim half of the refund back from the financial institution the fraudster used to receive the stolen money. So the cost of your refund will be split 50-50 between the two banks/payment service providers sending and receiving the fraudulent money.

This makes it even more of a priority for banks and payment providers to do all that they can to protect their customers from scams. If they can prevent fraud taking place, they won’t have to pay towards the cost of it.

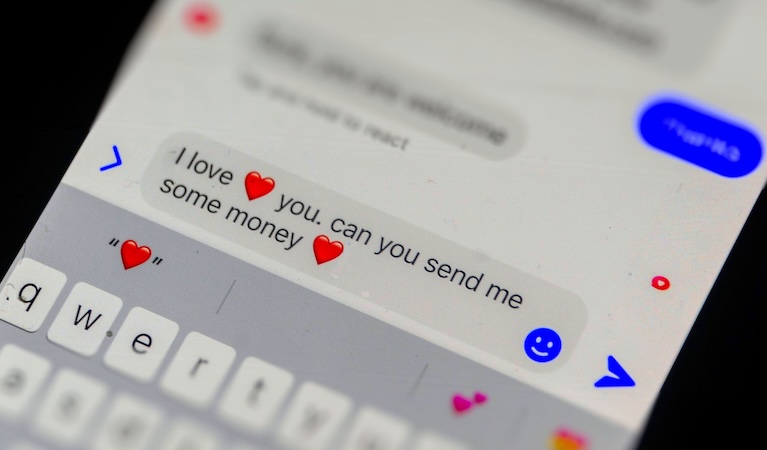

The most common financial scam for consumers is known as an APP – an Authorised Push Payment. An APP involves a scammer persuading you to make a bank transfer to another bank account. Three typical ways they can do this is by:

Before October there was no specific requirement for banks or payment providers to refund victims of APP fraud, but under the new refund rules APP fraud is now covered and will be treated like any other kind of fraud.

Before the new rules came into force, those banks that did offer fraud compensation to customers could pay out up to £415,000. But now the payout cap has been reduced to £85,000.

According to PSR – the Payment Systems Regulator – the £85,000 cap will cover more than 99% of claims. There were over 250,000 fraud compensation payouts in 2023, and only 411 of these were for more than £85,000. However, the consumer organisation Which? has raised concerns about the lowering of the cap and called for the impact of this to be monitored by the Payment Systems Regulator.

Even though most scams are well below £85,000, it is increasingly important to be extra vigilant about sophisticated scams that could potentially involve larger amounts, for example anything to do with your property.

Even with the recent changes, being scammed is still a very upsetting and frightening experience. So it’s important to know what to do if you have transferred money in what you now believe may be a scam.

Advice from the Financial Ombudsman is to follow four steps if you think you have been scammed:

If you’re unhappy with the way your bank or payment services provider deals with the situation you have the right to make a formal complaint to them. They are obliged to send an initial response within 15 days and a full response within 35 days.

If you are not happy with this response or if they don’t reply in time you can then complain to the Financial Ombudsman.

We hope that this article has given you some useful information on how recent changes to the law affect your rights to compensation if you are scammed, and what to do if you are scammed.

If for any reason your compensation is delayed and you need a personal loan to tide you over, remember that Loans 2 Go offer emergency loans that may be able to help.

For more useful financial and lifestyle tips, visit us here again soon at Loans 2 Go.

Loans 2 Go is a trading name of Loans 2 Go Limited, registered in England and Wales (company number 4519020). Loans 2 Go Limited is authorised and regulated by the Financial Conduct Authority (Firm reference number 679836). ICO registration number Z720743X. Registered office: Bridge Studios, 34a Deodar Road, London SW15 2NN.

Our lending products are regulated consumer credit agreements under the Consumer Credit Act 1974 and are not structured as short-term single-repayment credit facilities. Loan funds are paid by bank transfer once your application has been approved, subject to our working hours: Monday to Friday, 8am to 8pm, and Saturday, 8am to 5pm. All loans are subject to eligibility and affordability checks. The maximum APR offered is 815.6%. Loan repayment periods range from a minimum of 18 months to a maximum of 24 months.

As a lender, we may pay commission to credit brokers or other intermediaries who introduce customers to us. The amount of commission varies depending on the broker, the product offered and the terms agreed. This commission is paid by us and does not affect the interest rate, terms or total amount payable under your loan agreement.

© 2026 Loans 2 Go. All rights reserved.